As an education professor, you have dedicated your life to shaping the minds of future generations. You know the value of preparation, planning, and protection. But have you thought about securing your own future? Life insurance for educators is a critical consideration that often goes overlooked. In this comprehensive guide, we will delve into the world of education professor life insurance and explore the various options available to provide peace of mind for you and your loved ones. Whether you are just starting out in your career or are nearing retirement, this guide will provide valuable insights and information to help you make informed decisions about protecting your future.

Understanding Education Professor Life Insurance Cover: A Comprehensive Guide

Education Professor Life Insurance Cover is a type of insurance policy that provides financial protection to the family or dependents of an education professor in case of their untimely demise. This cover is designed to ensure that the beneficiaries receive a lump sum payment that can help them cover expenses such as mortgage payments, college tuition fees, and other living expenses. It is important for education professors to have life insurance cover because they often have significant financial responsibilities, including supporting their families and paying off student loans. In addition, many education professors may not have significant savings or retirement funds, making life insurance cover an essential investment. With the right policy, education professors can ensure that their loved ones are financially secure even after they are gone.

Why Education Professors Need Life Insurance: Explained

Education professors play an essential role in shaping the future of individuals and society as a whole. It is crucial for them to have life insurance coverage to protect their loved ones financially in case of any unforeseen circumstances. Life insurance can provide financial security for education professors’ families, ensuring that they are taken care of even after their passing. Education professors often have significant student loans, mortgages or other large debts which makes life insurance all the more important.

Life insurance acts as a safety net that helps cover expenses such as funeral costs, outstanding debts or help replace lost income when an education professor passes away unexpectedly. Considering these factors, it’s imperative that education professors invest in adequate life insurance coverage to ensure they’re protecting their loved ones from potential financial distress.

How to Choose the Right Life Insurance Cover for Education Professors

When choosing a life insurance policy for education professors, it’s important to consider the coverage amount and the policy type. The coverage amount should be enough to cover any outstanding debts, such as mortgages or student loans, as well as provide for any dependents in the event of the policyholder’s death. As for policy type, term life insurance is typically the most affordable option and provides coverage for a set period of time. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component that can accumulate cash value over time. It’s important to weigh the pros and cons of each policy type and choose one that aligns with your specific needs and budget. Additionally, consider factors such as the insurer’s financial stability and customer service reputation when selecting a provider.

Top Life Insurance Providers for Education Professors: A Comparison

Understanding the Unique Needs of Education Professors for Life Insurance

Education professors have unique needs when it comes to life insurance cover. They often have a steady income, but may also have significant student loan debt. Additionally, they may have dependents who rely on their income for support. When choosing a life insurance provider, it’s important to look for one that understands these specific needs and can offer tailored coverage options. Look for providers that offer flexible policy terms and coverage amounts that can be adjusted as your needs change over time. It’s also important to consider providers that offer additional benefits such as accidental death coverage or disability insurance.

Comparing Top Life Insurance Providers for Education Professors

When it comes to choosing the right life insurance provider for education professors, there are several options available in the market. Some of the top providers include XYZ Insurance and ABC Life Insurance. Both offer comprehensive coverage options that cater specifically to the needs of education professionals. While XYZ Insurance offers competitive rates and customizable policies, ABC Life Insurance provides additional benefits such as accidental death coverage and terminal illness coverage. It’s important to compare policies and rates from multiple providers before making a decision to ensure you get the best coverage at an affordable price.

Tips for Finding the Best Life Insurance Policy as an Education Professor

When searching for the best life insurance policy as an education professor, it’s important to keep a few key factors in mind. First and foremost, look for policies that offer coverage for accidental death or dismemberment, as well as disability benefits. Additionally, consider policies with flexible payment options and reasonable premiums based on your age and health status. Be sure to compare quotes from several providers to find the policy that offers the most comprehensive coverage at a price point you can afford. Don’t forget to read customer reviews and check each provider’s financial strength rating before making your final decision.

Common Misconceptions About Education Professor Life Insurance Cover

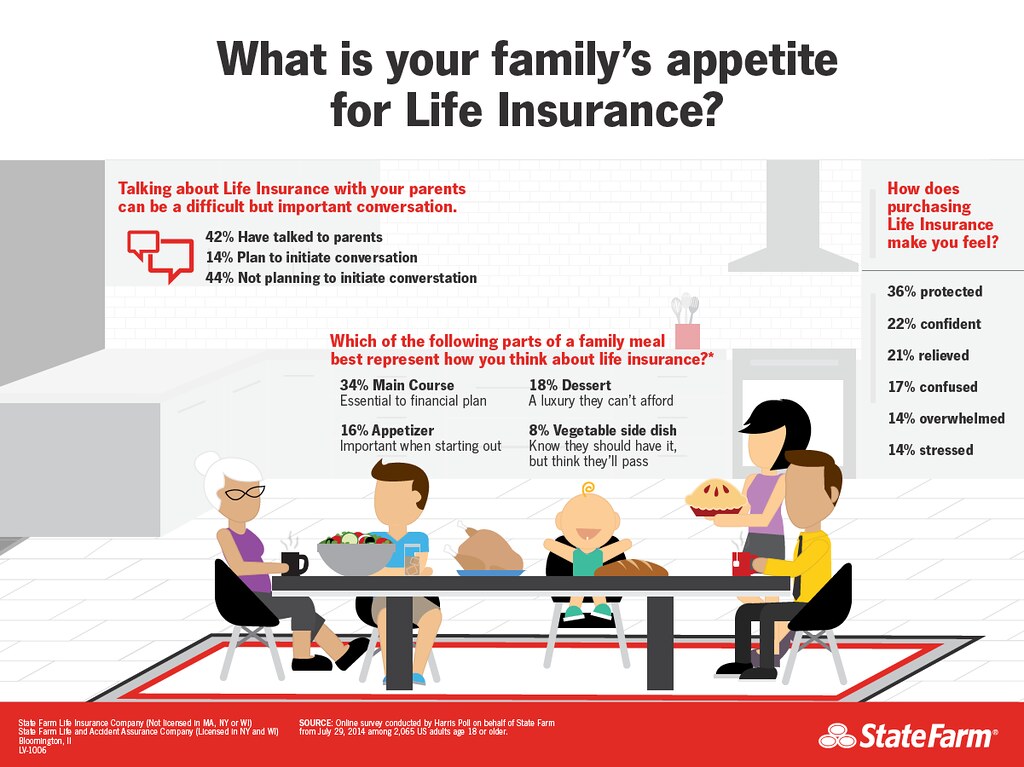

There are several misconceptions about life insurance for education professors that can prevent them from investing in a policy. One common misconception is that life insurance is only necessary for those with dependents. However, even if you don’t have dependents, a life insurance policy can provide financial support for funeral expenses and outstanding debts.

Another misconception is that life insurance policies are too expensive. In reality, there are many affordable options available, and the cost of a policy will depend on factors such as age, health, and coverage amount.

Some people also believe that they don’t need life insurance because they have savings or investments. While having savings is important, it may not be enough to cover all expenses in the event of an unexpected death.

It’s important to understand the facts about education professor life insurance cover and not let misconceptions prevent you from investing in a policy that can provide financial security for you and your loved ones.

The Benefits of Investing in Education Professor Life Insurance Cover

Investing in Education Professor Life Insurance Cover can provide a range of benefits for both you and your loved ones. In the event of your unexpected passing, your beneficiaries will receive a lump sum payment that can help cover expenses such as funeral costs, outstanding debts, and living expenses. Additionally, some policies may offer additional benefits such as terminal illness cover or the option to add critical illness cover.

One of the biggest advantages of Education Professor Life Insurance Cover is the peace of mind it can provide. Knowing that your loved ones will be taken care of financially can alleviate stress and worry during an already difficult time. It can also help ensure that your family’s future financial goals are still achievable.

When considering a policy, it’s important to choose one that aligns with your specific needs and budget. Working with a reputable provider and seeking guidance from a financial advisor can help ensure that you make an informed decision. Overall, investing in education professor life insurance is a smart choice for those looking to protect their loved ones’ financial future.

How to Calculate the Right Coverage Amount for Your Education Professor Life Insurance Policy

Calculating the Right Coverage Amount for Your Education Professor Life Insurance Policy

When it comes to choosing the right coverage amount for your education professor life insurance policy, there are a few factors to consider. Firstly, you need to think about your current financial situation and how much money your loved ones would need if you were no longer around. This includes any outstanding debts, mortgage payments, and living expenses.

Secondly, you should consider your future financial obligations. If you have children who will be attending college in the future or elderly parents who may need financial support, you’ll want to factor these expenses into your coverage amount.

Lastly, don’t forget to account for inflation. The cost of living will likely increase over time, so it’s important to choose a coverage amount that will provide adequate financial support in the future.

By taking these factors into consideration and working with a knowledgeable insurance agent, you can determine the right coverage amount for your education professor life insurance policy and have peace of mind knowing that your loved ones will be taken care of financially in the event of your passing.

Tips for Saving Money on Your Education Professor Life Insurance Premiums

Saving Money on your Education Professor Life Insurance premiums is possible with a few simple tips. First, consider purchasing your policy at a younger age when premiums are typically lower. Additionally, maintaining a healthy lifestyle can lead to lower premiums as insurance companies often take into account factors such as weight, blood pressure, and cholesterol levels. Comparing quotes from multiple providers can also help you find the best rates for your specific needs. Consider choosing a higher deductible or opting for term life insurance instead of whole life insurance to save on costs. Finally, make sure to review and update your policy regularly to ensure you are not paying for coverage you no longer need. By following these tips, you can save money on your education professor life insurance policy while still ensuring adequate coverage for yourself and your loved ones.

In conclusion, life insurance is an essential aspect of financial planning that education professors should not overlook. It provides a safety net for their loved ones in the event of unexpected death or disability. When choosing a life insurance policy, it’s crucial to understand your needs and do research on different providers to find the best fit. Don’t fall into common misconceptions about life insurance cover – instead, take advantage of its benefits and protect your family’s future today. By following the tips outlined in this guide, you can secure comprehensive coverage tailored to your unique circumstances while also saving money on premiums. Remember: investing in education professor life insurance is a wise decision that can bring peace of mind for years to come.

Frequently Asked Questions

Who is eligible for Education Professor Life Insurance Cover?

Education professors who are members of the insurance scheme.

What does Education Professor Life Insurance Cover include?

It includes life insurance, disability cover, and critical illness cover.

How much does Education Professor Life Insurance Cover cost?

The cost varies depending on factors like age and coverage amount.

Who pays for Education Professor Life Insurance Cover?

The education institution or the professor can pay for it.

What happens if I leave my job as an education professor?

You can still keep your life insurance cover by converting it to an individual policy.

How do I make a claim on my Education Professor Life Insurance Cover?

Contact the insurance provider and provide the necessary information and documentation.