Are you starting a new career as an accounts clerk in the banking industry? Congratulations on this exciting milestone! However, have you thought about safeguarding your future and protecting your loved ones? With the unpredictable nature of life, it’s crucial to have a safety net in place. In this blog post, we’ll explore how securing new accounts clerk banking life insurance cover can provide peace of mind and protect your financial future. Don’t wait until it’s too late – keep reading to find out more.

Understanding the Importance of Life Insurance for New Accounts Clerks in Banking

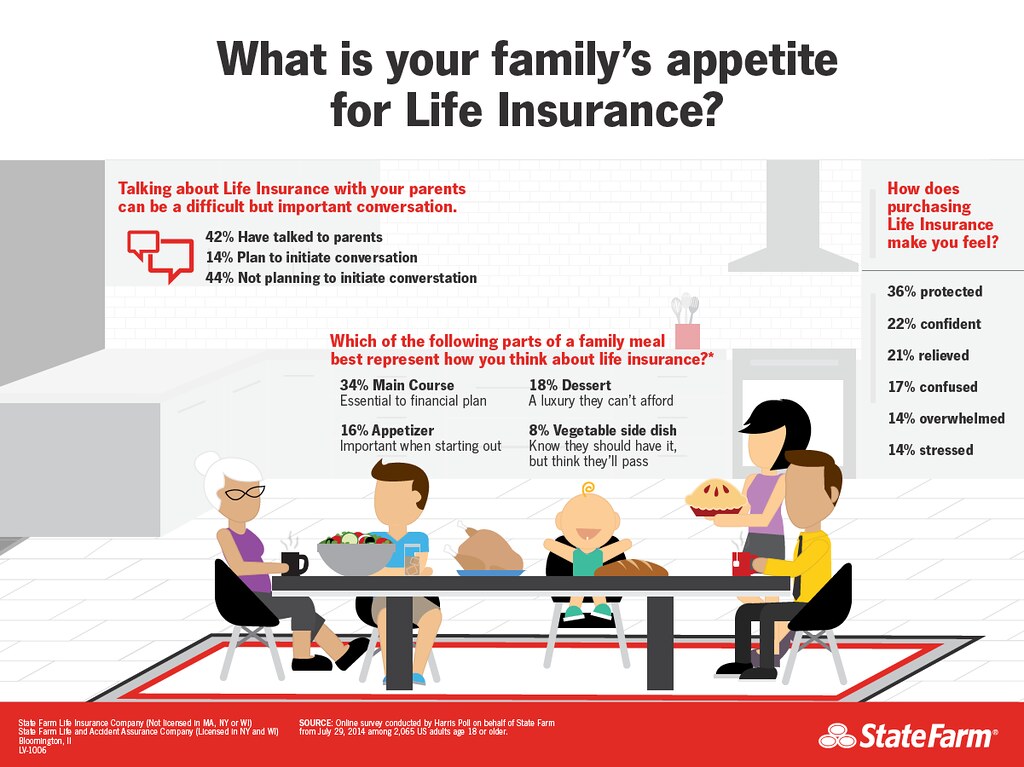

New Accounts Clerk Banking Life Insurance Cover is a crucial investment for anyone working in the banking industry. As a new accounts clerk, you are responsible for managing customer accounts and ensuring their financial security. However, have you considered your own financial security? Life insurance provides a safety net for your loved ones in the event of your unexpected death. It can cover funeral expenses, outstanding debts, and provide ongoing financial support for your family. As a new accounts clerk, you may be eligible for group life insurance through your employer, but it’s important to assess whether this coverage is sufficient for your needs. Taking the time to understand the importance of life insurance and securing adequate coverage can provide peace of mind and safeguard your future.

How to Choose the Right Life Insurance Cover for Your Needs

When choosing a life insurance cover as a new accounts clerk in banking, it’s important to consider your specific needs and budget. Term life insurance is a popular option for those looking for affordable coverage for a set period of time, while whole life insurance provides lifelong coverage with the added benefit of building cash value over time. It’s also important to consider the amount of coverage you need based on factors such as your income, debts, and dependents. Additionally, take into account any additional riders or benefits that may be available with certain policies, such as accidental death coverage or disability income protection. Comparing quotes from multiple providers can help you find the best policy for your individual situation.

Exploring the Benefits of New Accounts Clerk Banking Life Insurance Cover

As a new accounts clerk in banking, life insurance cover can provide you with peace of mind and financial security. In the event of your unexpected death, your loved ones will receive a lump sum payment that can help cover expenses such as funeral costs, outstanding debts, and living expenses.

Additionally, some life insurance policies offer additional benefits such as critical illness cover or income protection in case you are unable to work due to an illness or injury. This can provide you with a safety net during difficult times and ensure that you are able to maintain your standard of living.

Moreover, having life insurance can also benefit your employer by demonstrating that you are a responsible and reliable employee who is committed to safeguarding their financial future. It can also help attract and retain talent within the organization.

Overall, investing in new accounts clerk banking life insurance cover is a smart decision that can provide numerous benefits for both you and your loved ones.

Factors to Consider When Securing Your Future with Life Insurance

When securing your future with life insurance, there are several factors to consider. One important factor is the amount of coverage you need. As a new accounts clerk in banking, you may want to consider how much your loved ones would need to cover expenses such as funeral costs, outstanding debts, and living expenses in the event of your unexpected passing. Another key factor is the type of policy that best suits your needs. Term life insurance may be a good option for those who want coverage for a specific period of time, while permanent life insurance provides lifelong coverage and can also serve as an investment vehicle. It’s important to carefully evaluate your options and choose a policy that aligns with your financial goals and needs.

Tips for Comparing Different Life Insurance Policies and Providers

When comparing different life insurance policies and providers, it’s important to consider a few key factors. First, look at the premium cost and ensure that you can afford it within your budget. Second, consider the coverage amount offered by each policy and whether it aligns with your needs. Third, examine any exclusions or limitations in the policy to make sure you understand how they may affect your coverage.

Additionally, take note of any additional benefits or riders offered by different policies. For example, some policies may offer accelerated death benefits if you are diagnosed with a terminal illness, while others may offer waiver of premium in case of disability.

Lastly,compare customer reviews for different providers to get an idea of their level of service satisfaction among past clients. Keep in mind that the cheapest option isn’t always the best and prioritize finding a quality policy from a reputable provider over cutting costs at every turn.

Common Mistakes to Avoid When Buying Life Insurance as a New Accounts Clerk

When buying life insurance as a new accounts clerk, it’s important to avoid common mistakes that can lead to inadequate coverage or higher premiums. One key mistake to avoid is underestimating your coverage needs. While it may be tempting to opt for a lower coverage amount to save on premiums, this can leave your loved ones financially vulnerable in the event of your unexpected death. On the other hand, overestimating your coverage needs can lead to unnecessarily high premiums. It’s important to carefully assess your financial obligations and future goals when determining the appropriate coverage amount. Additionally, be sure to disclose all relevant information about your health and lifestyle habits, as failing to do so can result in denied claims or higher premiums.

How to Maximize Your Coverage and Minimize Your Premiums

Understanding the Benefits of New Accounts Clerk Banking Life Insurance Cover

New Accounts Clerk Banking Life Insurance Cover offers several benefits that can help you secure your future. Firstly, it provides financial protection to your loved ones in case of any unforeseen circumstances. Secondly, it ensures that your debts and liabilities are taken care of even after you’re gone. Moreover, it can also act as a savings plan and help you accumulate wealth over time. By choosing the right coverage amount and policy term, you can maximize your coverage and minimize your premiums. It’s important to compare different policies and providers to find the one that suits your needs and budget.

Tips for Maximizing Your Life Insurance Coverage as a New Accounts Clerk

To maximize your life insurance coverage as a new accounts clerk in banking, consider purchasing a policy with a higher death benefit. This will ensure that your loved ones are financially secure in the event of your unexpected passing. Additionally, opt for a policy with a longer term length to provide coverage for a longer period of time. To minimize your premiums, maintain a healthy lifestyle and avoid risky behaviors such as smoking or excessive drinking. You can also choose to pay your premiums annually instead of monthly to save money in the long run. Lastly, shop around and compare policies from different providers to find the best coverage at the most affordable price.

How to Minimize Your Premiums While Maintaining Adequate Life Insurance Coverage

One way to minimize your premiums while still maintaining adequate life insurance coverage is to opt for term life insurance. This type of policy provides coverage for a specific period, such as 10 or 20 years, and tends to be more affordable than permanent life insurance. Another strategy is to improve your overall health by quitting smoking, exercising regularly, and maintaining a healthy weight. This can help you qualify for lower premiums. Additionally, consider bundling your life insurance policy with other types of insurance, such as auto or home insurance, as this can often result in discounted rates.

Choosing the Right Life Insurance Policy for Your Future Financial Security

When it comes to maximizing your coverage and minimizing your premiums, choosing the right life insurance policy is crucial. As a new accounts clerk in banking, you want to ensure that your future financial security is protected. To do this, you need to consider factors such as the type of policy, coverage amount, and premium payments. Term life insurance policies may be a good option for those who want affordable coverage for a specific period of time. On the other hand, permanent life insurance policies offer lifelong coverage and can also serve as an investment tool. It’s important to weigh the pros and cons of each type before making a decision.

Navigating the Fine Print: Understanding Policy Terms and Conditions

Policy terms and conditions can be complex, so it’s essential to read them carefully before signing up for a life insurance plan. The policy document will outline the benefits and limitations of your coverage, as well as any exclusions that may affect your ability to make a claim.

Pay close attention to factors such as the length of the policy, premium payment frequency, and options for renewing or canceling the coverage. You’ll also want to look at how long you need to pay premiums before you’re eligible for benefits (the waiting period) and whether there are any penalties or fees for early termination.

Other important details include how beneficiaries are designated and what happens in case of accidental death or suicide within a certain timeframe after buying the policy. By understanding these terms upfront, you can avoid confusion later on and feel confident that you’ve made an informed decision about protecting yourself in case of unforeseen events.

Planning Ahead: Why It’s Never Too Early to Invest in Life Insurance

Invest in life insurance as early as possible to secure your future and protect your loved ones. As a new accounts clerk in banking, you may not have dependents or significant assets yet, but that doesn’t mean you should put off getting life insurance. In fact, the younger and healthier you are when you buy a policy, the lower your premiums will be. Plus, life is unpredictable, and accidents or illnesses can happen at any age. By planning ahead and investing in a comprehensive life insurance policy, you can ensure that your loved ones are taken care of financially if something unexpected happens to you. Don’t wait until it’s too late – start researching your options for life insurance today.

In conclusion, securing life insurance cover as a new accounts clerk in banking is a vital step towards safeguarding your future and protecting your loved ones. By understanding the importance of life insurance, choosing the right policy, exploring its benefits, considering important factors during purchase, avoiding common mistakes and planning ahead one can maximize their coverage while minimizing premiums. With so many different policies and providers in the market today, it’s important to compare them carefully to ensure you get the best coverage possible. Don’t wait until it’s too late; invest in life insurance now and enjoy peace of mind knowing that you’re prepared for whatever comes next.

Frequently Asked Questions

Q.Who is a New Accounts Clerk in Banking?

A.A clerk who opens new accounts for bank customers.

Q.What is Life Insurance Cover?

A.An insurance policy that pays out a sum of money upon the death of the insured.

Q.How does a New Accounts Clerk help with Life Insurance Cover?

A.They can assist customers with opening accounts that may qualify for insurance benefits.

Q.Who can benefit from Life Insurance Cover?

A.Anyone who wants to ensure financial protection for their loved ones after their death.

Q.What objections might someone have to Life Insurance Cover?

A.They may think it’s too expensive or unnecessary.

Q.How can you address objections to Life Insurance Cover?

A.By explaining the potential financial burden on loved ones and offering affordable options.