Life insurance aims to protect individuals from the financial consequences of uncertainty and unpredictability.

Most people believe that getting insurance to cover all types of future unpredictability is easy.

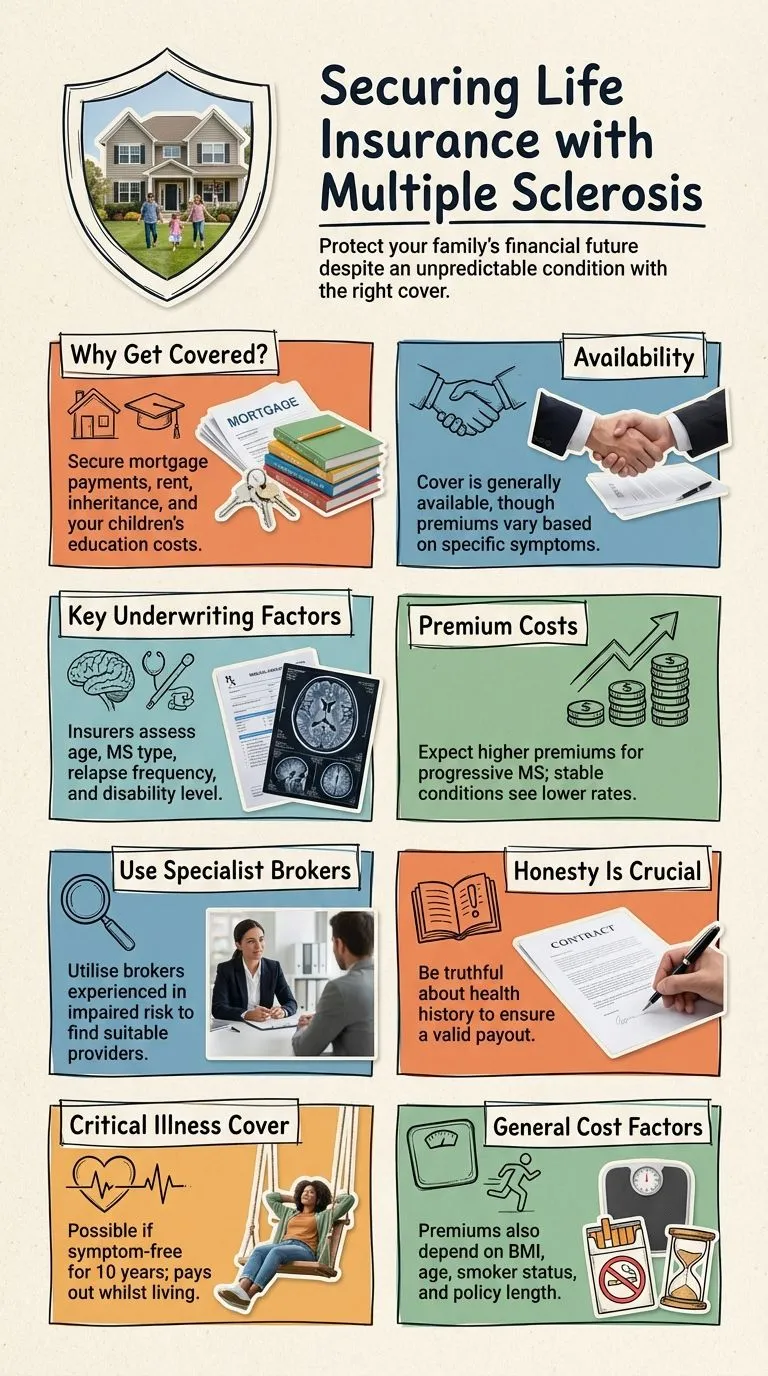

However, for people with multiple sclerosis (MS), the stability and security that should come from insurance are often either unavailable, expensive, or inadequate for their needs.

This raises many questions and even more uncertainty for those with MS, so the following information aims to shed some light on a confusing subject.

Multiple Sclerosis Life Cover From Claybrooke – Quick Quote Form

Can I make a claim under my existing insurance?

You may be able to claim policies you already hold, depending on the type of insurance.

Some examples of policies that can help you include those that will (1) pay out a lump sum (critical illness cover), (2) help with income replacement (income protection), and (3) pay some medical bills (private medical insurance).

Check the fine print to see if your policy covers MS and under what circumstances it pays out. The claims section details how to make a claim and the conditions it covers, so it is suggested that you start there.

For products like income protection and private medical insurance, the small print lists exclusions on what they cover and how they pay out.

With most policies like those mentioned, you need to notify them of the condition within a certain timeframe to make a claim and receive a payout.

When it comes to private health care, chronic and incurable conditions like MS are usually not covered, though the costs for diagnosis (a neurologist or another specialist) may be covered.

Disclosure

Suppose you took out your policy before your MS diagnosis. In that case, you are not required to inform your insurer about any changes in your condition since the policy began unless you make a claim or your policy’s terms require you to do so.

If you are unsure, ask your insurer about what you must disclose.

Click To Compare QuotesHowever, if you are diagnosed after you apply for the policy but before the insurer begins coverage, you must disclose your MS condition to the insurer.

Even though the information was correct when you applied, you cannot knowingly misrepresent yourself in your policy before it begins to be enforced.

For policies that run for years, you must inform your insurer of your condition. Some examples include travel, private medical, critical illness, and income protection policies.

If you don’t update your insurer, you will likely not be covered if you have to make a claim.

Taking out insurance after an MS diagnosis

An MS diagnosis does affect your ability to take out some forms of insurance, usually in the form of higher monthly premiums.

For instance, standard home and motor insurance policies will likely increase premiums if you need coverage for anything beyond the ordinary terms, such as a wheelchair or stair lift.

You must still be upfront about your condition when applying for all types of insurance.

If you are not upfront, insurers may even go so far as not to pay out claims caused by MS if you knowingly took out coverage without fully disclosing the extent of your condition.

Specialist insurance

Standard travel insurance, home insurance, and motor policies are likely inadequate for individuals with MS.

Standard policies may not cover equipment, particular vehicle adaptations, caregivers, and other special costs.

Most travel insurance policies exclude pre-existing medical conditions, which means that you cannot make claims under the policy for any medical costs or holiday cancellations due to a pre-existing condition like MS.

However, specialist brokers such as Claybrooke can source policies that do not exclude MS or other pre-existing medical conditions from standard forms.

Check your policy

Always remember to check your policy to ensure it provides the coverage you have purchased.

If you have any doubts about your coverage, contact your insurer and ask him or her to clarify exactly what coverage you have for claims resulting from MS.

Suppose your policy is inadequate for your needs. In that case, some policies cater more to the needs of individuals with MS by incorporating their requirements into the standard policy or by offering specific types of insurance.

Even if these policies seem more expensive at first glance, they may, in fact, be more accommodating to the specifics of your condition.