Thinking about being diagnosed with cancer can be a complex subject.

Although hard to consider, obtaining cancer insurance can be an effective way to protect loved ones in the event of a diagnosis.

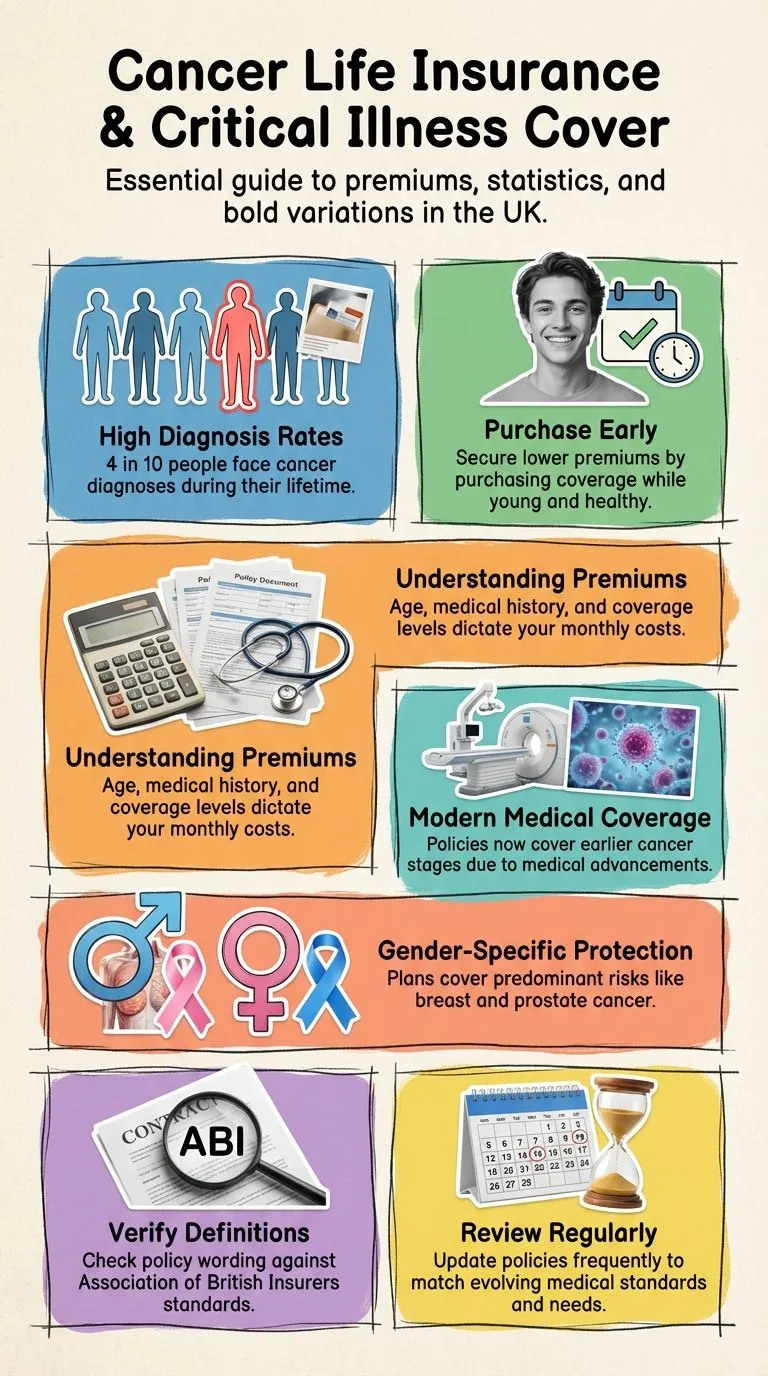

It has been reported that 4 out of 10 people are diagnosed with cancer at some point in their lifetime. With statistics like these, isn’t it better to have cancer insurance protection?

Claybrooke is here to discuss all the options and help you find a cancer insurance policy that meets your needs.

Get A Cancer Life Insurance Or Critical Illness Quote Today

Understanding Cancer Insurance Premiums

Various factors, including age, health history, and the desired coverage level, influence cancer insurance premiums.

Younger, healthier applicants often benefit from lower premiums because they pose less risk to insurers.

Additionally, opting for a higher level of coverage will typically result in increased premium costs.

It’s beneficial to understand the difference between fixed and variable premiums: fixed premiums remain constant throughout the policy term, whereas variable premiums may fluctuate.

Purchasing coverage early can often secure a lower premium rate, which can be financially advantageous in the long term.

What is Critical Illness Coverage?

Many insurance policies include critical illness coverage, and cancer life insurance is typically included in these plans.

These policies usually cover individuals up to age 75, and some up to 85.

Statistics show that a tenth of all new cancer diagnoses occur earlier than age 50, and more than 50 per cent of new diagnoses are made before 75.

Factors Affecting Critical Illness Coverage

Critical illness coverage is influenced by several factors, including the policyholder’s age and lifestyle.

Insurers also consider existing medical advancements that allow for early detection and treatment of diseases.

Click To Compare QuotesPre-existing conditions can affect eligibility, sometimes resulting in limited coverage or higher premiums.

Being aware of these factors is essential when discussing policy options with your provider, ensuring you select coverage that suits your health and financial needs.

For these reasons, it is important to consider both the emotional and financial implications a cancer diagnosis can have on your family and determine if this coverage is appropriate for you.

Cancer Insurance Cover Most Commonly Suffered Diagnoses

Currently, the most predominant forms of cancer are breast cancer in women and prostate cancer in men.

With advances in medical science, more and more insurance policies are covering earlier stages of these conditions.

Breast cancer in women accounts for 30 per cent of all cancer diagnoses in the United Kingdom.

Previously, cancer insurance and critical illness coverage would only cover specific surgeries for this condition, namely a mastectomy.

Several providers have revised their policies to include payment for claims related to all types of surgery.

New Medical Advancements Impacting Coverage

Recent advancements in medical science, particularly in the early detection and treatment of cancer, have prompted insurance companies to expand their coverage options.

These innovations allow insurers to cover earlier phases of cancer, providing policyholders with financial support at critical times.

With early diagnosis improving treatment outcomes, insurers are increasingly recognising the need for policies that encompass a broader range of cancer stages, supporting better patient care and financial planning.

Prostate Cancer Life Insurance

Nearly 25 percent of all cancer diagnoses in men in the United Kingdom are prostate cancer.

Because of medical advances and the ability to detect these types of conditions early on, insurance providers are now covering lower-grade forms of prostate cancer.

Click To Compare QuotesThis allows policyholders to claim earlier with their insurance provider, reducing the severity of the qualifying condition.

It also allows both men and women with cancer insurance to reduce the financial burden of treating their disease early, helping to give them a better quality of life overall.

Comparing Providers

When comparing cancer insurance providers, consider factors such as policy variety, premium costs, and the efficiency of claim handling.

Some providers offer more comprehensive plans, while others might focus on cost-saving options.

It’s important to evaluate customer service and reputation, as well as specific features tailored to conditions or lifestyles.

Researching top UK insurers can help you find a provider that aligns with your personal healthcare needs and financial expectations.

Cancer Insurance Policies – Not Created Equal

If you already have cancer insurance, it is essential to review your policy regularly.

Advances in medical science and early detection for these conditions may make some existing policies outdated.

Additionally, when purchasing a cancer insurance policy for the first time, it is essential to review the policy’s guidelines for what is covered for a claim.

Cancer is a “core critical illness” and is subsequently covered under all critical illness coverage policies.

However, it is essential to examine the Association of British Insurers’ (ABI) definition of cancer.

Regular policy reviews are necessary to ensure your insurance remains up to date with current medical standards and your personal needs.

As medical advancements occur, previously applicable benefit limits or exclusions may no longer apply.

Staying informed about these changes can help you adjust your coverage, ensuring it continues to meet your requirements as personal and medical circumstances evolve.

Types Of Malignancy

The ABI defines cancer as “a diagnosis of a malignant tumour as positive with histological confirmation by the invasion of tissue and uncontrolled growth of harmful cells.”

Due to this definition, not all policies will cover the initial or early stages of a cancer diagnosis.

Specifically, forms of cancer such as pre-malignant, not invasive, borderline malignancy and low malignant potential may not be covered under cancer insurance.

Claybrooke can help policy seekers explore different options for cancer insurance and help ensure that all of their coverage needs are met.

Although the above definition and explanation may seem troubling, insurance companies are aware of the medical advances that allow for earlier detection of cancer cells.

It is important to note that many critical illness policies go beyond the Association of British Insurers standard, offering coverage for less advanced stages of cancer.

Cancer defined in these types of policies is often referred to as among the covered forms of cancer, including low-grade prostate cancer, testicular carcinoma and other early-stage cancer diagnoses.

Cancer insurance can offer you and your family peace of mind and financial protection.

These policies should be purchased as soon as possible – premiums for this type of coverage generally increase as policy seekers age.

It may be more financially responsible to lock in a lower rate before health risks and premiums increase.

Claybrooke can help cancer insurance policy seekers explore different critical illness coverage options and find the best possible protection for themselves and their families.

External Resources: