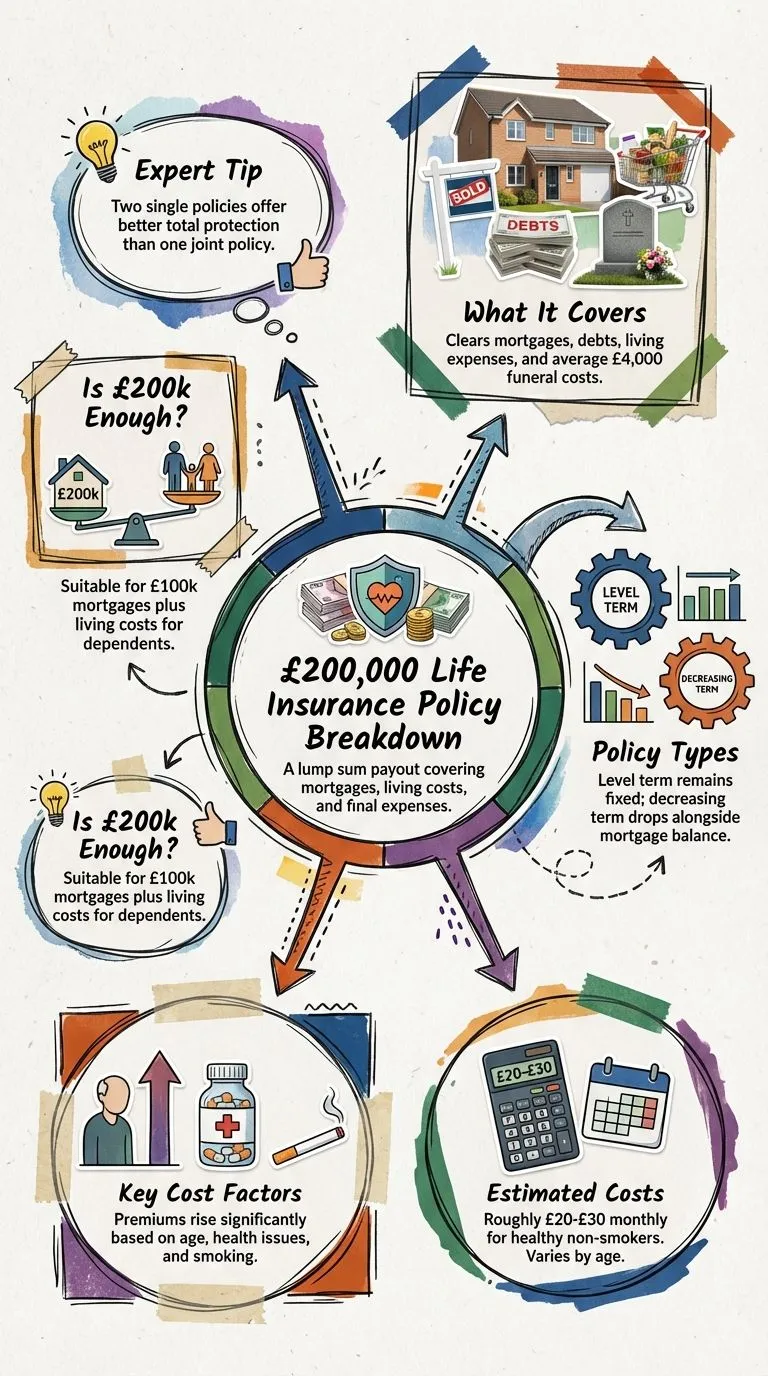

A £200 000 life insurance policy costs approximately £20.50 per month for someone aged 35-40. For young people, much cheaper policies are available starting at under £7 for a non-smoker.

- £200,000 of life insurance is appropriate for people earning approximately £25,000, who have some savings and a mortgage of around £100,000.

- If you have very young children, a large mortgage and little or no savings, more than £200,000 of life insurance may be more appropriate to support your family’s future everyday living expenses.

When considering the amount of coverage for a life insurance policy, we often want to ensure our family will be well provided for if we pass away.

A £200,000 life insurance policy gives consumers peace of mind that final expenses and outstanding debts will be paid and that they will have financial support for loved ones in their time of need.

Do You Need £200K Of Life Insurance Cover? Get A Quote Today

Below is an example of monthly premiums for a £200,000 level term life insurance policy in the UK over a 25-year term.

This assumes that the person is in good health and doesn’t work in a high-risk occupation. The data is for both smokers and non-smokers aged 20–50.

| Persons Age | Smoker (approximate cost £/month) | Non-Smoker (approximate cost £/month) |

| 20 | £6.74 | £5.53 |

| 25 | £7.16 | £5.24 |

| 30 | £9.80 | £5.91 |

| 35 | £14.41 | £7.87 |

| 40 | £19.65 | £10.38 |

| 45 | £26.71 | £16.34 |

| 50 | £42.10 | £23.76 |

Why People Choose To Pay Life Insurance Premiums

There is no requirement for people to have life insurance policies, and depending on what stage of life you are in, it is possible that you do not need this type of coverage.

The truth, however, is that many people who do not think they need life insurance or have not considered purchasing coverage are often the ones who need it most.

It is important to think about the future and what your family will do financially should your income no longer be available to help pay household expenses.

Many people believe life insurance is just an added expense to the budget, and the likelihood it will be needed is slim to none.

Click To Compare QuotesWhile the unexpected death of the primary breadwinner is rare, it is essential to remember that anything can happen and should something happen to you, your family will need to be supported.

For individuals whose families depend on their income, it is important to consider all the possibilities to ensure the family’s financial protection.

Those who purchase life insurance early in life often find that the value of having a policy outweighs the expense.

This gives policyholders the peace of mind that their family can afford final expenses and pay off outstanding debts when they pass away.

Additionally, people who purchase life insurance and then develop health issues find the policy even more valuable, knowing their families will not be burdened should something happen.

Popular Types of Life Insurance Policies – Term Life Insurance Covers You In A Cost-Effective Way

- Term life insurance, one of the most popular policies, is usually chosen by individuals who want to ensure a fixed liability, such as an outstanding mortgage, is accounted for in the family’s finances.

- Term life insurance coverage lasts for a certain amount of time, usually between 20 and 50 years.

- Another popular option is whole of life assurance, which provides coverage for the policyholder for the entirety of his or her life. This adds an additional level of financial protection for surviving family members.

What Life Insurance Costs – How Much Life Insurance Do You Need?

When referring to the “cost of life insurance,” we often refer to the monthly premium payment. Insurance companies calculate several factors to determine the premium rate.

Some of these factors include the type of policy, the required coverage amount, the individual’s overall health, and whether she is already a smoker.

While most policy seekers are accepted with standard premiums, they also have the option to decline coverage and seek out other options should the premiums being offered seem too high.

Premium rates for life insurance have been falling over the last few years, making it even more important to compare different insurance company’s rates and options.

Claybrooke can help you provide a comprehensive comparison of different rates for several different policy options and term lengths.

Click To Compare Quotes£200 000 Life Insurance Plan – No High Risk Job – Non Smoker

Below, we have compiled a table of approximate rates for whole of life insurance coverage worth £200,000 for terms of 20, 30 and 50 years for both smoking and non-smoking individuals.

*higher premiums for smokers

Finding the Best Life Insurance Quote From Top Life Insurance Companies

With many options available, it can be hard to find the best insurance company and policy to meet your needs.

The professional life insurance advisors at Claybrooke can help you easily compare life insurance options that fit your unique situation and also help you find the best possible premium rate for the coverage you desire.

Our knowledgeable insurance advisors are always on standby to help you find the perfect life insurance to help financially protect your family.

Does Claybrooke offer increasing term insurance?

Claybrooke offers life insurance at £23.57 per month for £ 283,000 of cover.

Does Claybrooke do level term insurance Cover?

Yes, Claybrooke life cover is £13.59 per month for £236000 of cover.

Does Claybrooke do £200 000 life insurance policy with health and lifestyle cover?

Yes, a £ 200,000 life insurance policy costs approximately £20.09 per month.

Does Claybrooke do Income protection insurance?

Yes, Claybrooke Income protection insurance is £16.95 per month.

Does Claybrooke do mortgage life insurance?

Yes, Claybrooke mortgage life insurance is £17.22 per month for £200000 of cover.

What are the current rates for critical illness cover?

Claybrooke’s rates for critical illness cover are £20.59 per month for £200000 of cover.

Does Claybrooke have excellent reviews for life insurance cover?

Yes, Claybrooke reviews are splendid for life insurance. We have a simple approach to life insurance rates.

Does the Claybrooke life insurance calculator show the monthly costs?

Yes, the Claybrooke life insurance calculator shows excellent monthly premiums.

Does a Claybrooke life insurance advisor charge a big fee?

No, Claybrooke life insurance advisors are free. Life insurance rates are paid directly to the insurer.

Do you offer whole life insurance policies?

Yes, Claybrooke Whole Life Insurance is £26.73 per month for £215000 cash sum cover.

Does Claybrooke offer Joint life insurance?

Yes, the cost of Joint life insurance is £20.92 per month for £200,000 of cover. If you want low-cost life insurance for two people, this is the most cost-effective way.

Does Claybrooke offer Terminal illness cover?

Yes, Terminal illness cover is £18.33 per month for £211,000 cash value.

Does Claybrooke offer Term life insurance?

Yes, a term life insurance policy is £26.36 per month for £229,000 of cover.

Does Claybrooke do Decreasing term life insurance?

Yes, Claybrooke does offer decreasing term life insurance at £28.25 per month for a £200,000 lump sum payout.

Are you able to offer increasing term life insurance with funeral costs included?

Yes, Claybrooke does increasing term life insurance at £26.77 per month for £200,000 of cover.

Does Claybrooke do Level term life insurance?

Yes, Claybrooke does offer level term life insurance at £28.16 per month for £214,000 of cover.

Does Claybrooke offer Family Income Benefit Life Insurance?

Yes, Claybrooke does family income benefit life insurance at £27.92 per month for £248,000 of cover.