The best life insurance companies in the UK are currently separated by age range and risk tolerance.

The insurers that offer the best cover for younger, low-risk people are different from the ones that offer great cover for smokers aged 50+.

The tables below illustrate different insurers for different types of people.

Claybrooke calculates the star rating, considering cost, policy exclusions, and other terms.

Top 10 Life Insurance Companies UK

Prices for a 25-year-old male for £100,000 of cover for 10 years.

| Insurance Company | Non-Smoker Monthly Cost (£) | Smoker Monthly Cost (£) | Star Rating |

|---|---|---|---|

| Royal London | 6.21 | 9.51 | ★★★★★ |

| Zurich | 6.35 | 9.75 | ★★★★★ |

| Scottish Widows | 6.75 | 10.26 | ★★★★☆ |

| Liverpool Victoria | 6.90 | 10.52 | ★★★★☆ |

| AIG | 7.01 | 10.75 | ★★★☆☆ |

| VitalityLife | 7.15 | 11.01 | ★★★☆☆ |

| Nationwide | 7.25 | 11.25 | ★★★☆☆ |

| Aviva | 7.52 | 11.52 | ★★★☆☆ |

| Aegon | 7.75 | 11.77 | ★★☆☆☆ |

Prices for a 35-year-old male for £200,000 of cover for 15 years.

| Insurance Company | Non-Smoker Monthly Cost (£) | Smoker Monthly Cost (£) | Star Rating |

|---|---|---|---|

| Liverpool Victoria | 19.21 | 28.75 | ★★★★★ |

| Zurich | 19.50 | 29.00 | ★★★★★ |

| Royal London | 19.75 | 29.25 | ★★★★☆ |

| Scottish Widows | 19.90 | 29.50 | ★★★★☆ |

| Aviva | 20.10 | 29.75 | ★★★★☆ |

| VitalityLife | 20.25 | 30.00 | ★★★☆☆ |

| AIG | 20.75 | 30.50 | ★★★☆☆ |

| Nationwide | 21.00 | 30.75 | ★★☆☆☆ |

| Aegon | 21.25 | 31.00 | ★★☆☆☆ |

Picking The Best Life Insurance Policy

Comparing the market for life insurance policies takes a strategic approach. After all, there are hundreds of providers. Narrowing the playing field helps to get the most comprehensive cover.

That’s what we’ve done here at Claybrooke for our updated list of the best insurance firms across the UK for 2025.

Finding the best plans and prices for high-level cover has never been easier.

For this update, we’ve analysed all the major insurers and pitted them against each other using a combination of data from insurance policies and the data from the Fairer Finance consumer help group’s customer experience data.

Only the larger insurance firms cover all types of insurance policies. Some of the niche providers have great deals as well, though. You’ll be surprised to see some familiar names from the high street make it onto this year’s list of the top life insurance firms.

The three most popular types of life insurance people search for are:

- Term insurance

- Whole of Life Insurance

- Over 50s Plan

We focused our research on ten of the best insurance companies and the plans they offer, which provide value to customers and offer comprehensive policies.

To help understand what the policies offer, continue reading below for a quick overview of how life insurance plans work, so you know which chart to reference to narrow your choice of providers down to ten, rather than all thirty, which is less than 10% of all the providers we compare for our customers.

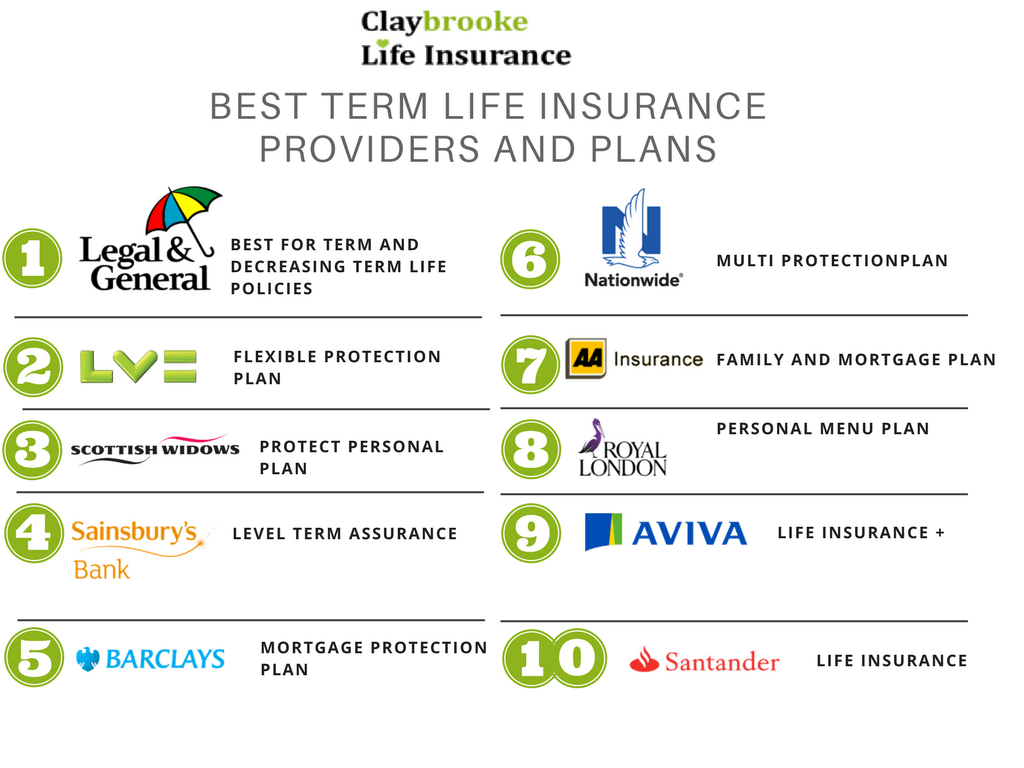

Top 10 Best Life Insurance Companies UK By Type:

Best For Term Life Insurance For People With A Repayment Mortgage

Term Life Insurance is ideal for mortgage protection. It can be linked to your mortgage’s remaining value, whereby the sum insured lowers each year as you’ll have paid more towards your outstanding balance.

Your premiums won’t, though. They’re still lower because they’re tired, though. A ten-year fixed term would be ideal if you have ten years left to run on your mortgage.

If you’re buying your home, you can set up term life insurance for your mortgage terms. The less you owe towards your mortgage, the less the premiums will be.

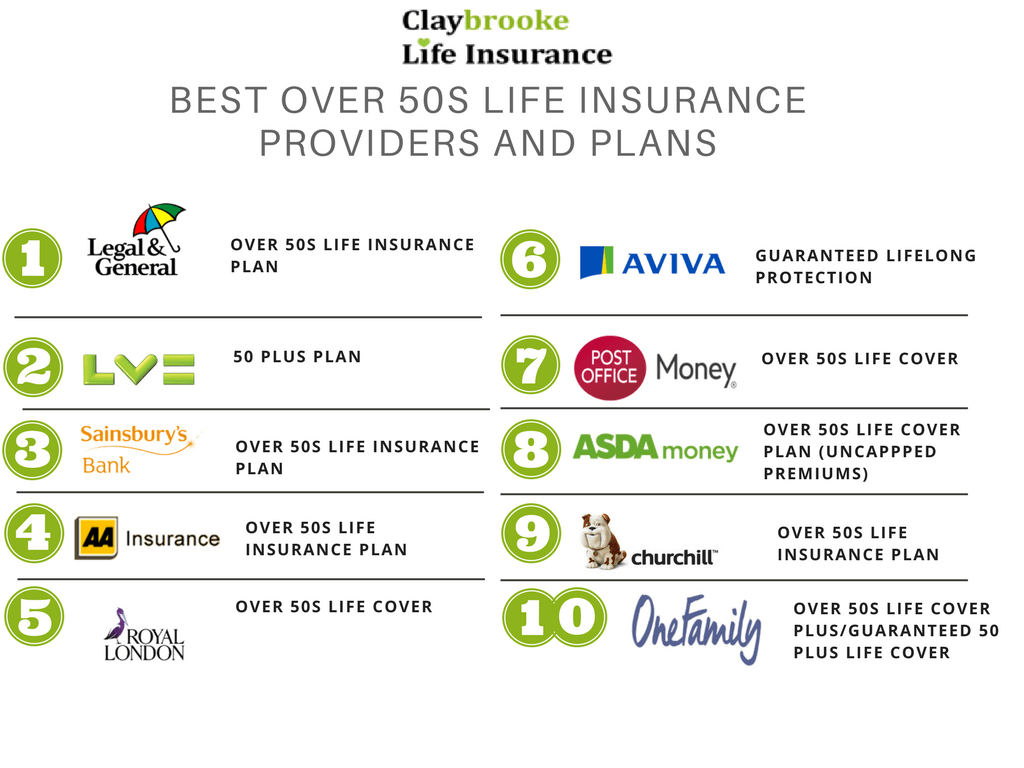

The Best Over 50s Life Cover Tolerant Of Pre Existing Medical Conditions

These are hard to categorise as the best, as the plans are often overhyped. These are the most basic of plans; they lock you in for life, and you won’t get a penny if you miss a payment.

Nonetheless, some people need them. Those are people with health problems who struggle to afford the monthly premiums on term or whole of life policies due to their medical conditions.

Sometimes, existing health problems make it difficult to obtain any type of cover, and that’s the only time the guaranteed life plan for over-50s may be worth it.

Don’t approach it lightly, though. Do the maths before taking the plan out. The Government have a handy life expectancy calculator that’s supposed to be used for pension planning.

To give an example, let’s take Sunlife’s scenario on their how much will it (theoretically) cost page.

A 60-year-old male paying £20 per month would guarantee a payout of £4,444. The life expectancy tool estimates that a 60-year-old male will live another 26 years.

Paying £20 per month for that many years would total £6,240. More would have been paid in than is being returned.

Not precisely solid financial planning. But, it can have its place if you really are struggling to get any life insurance in place.

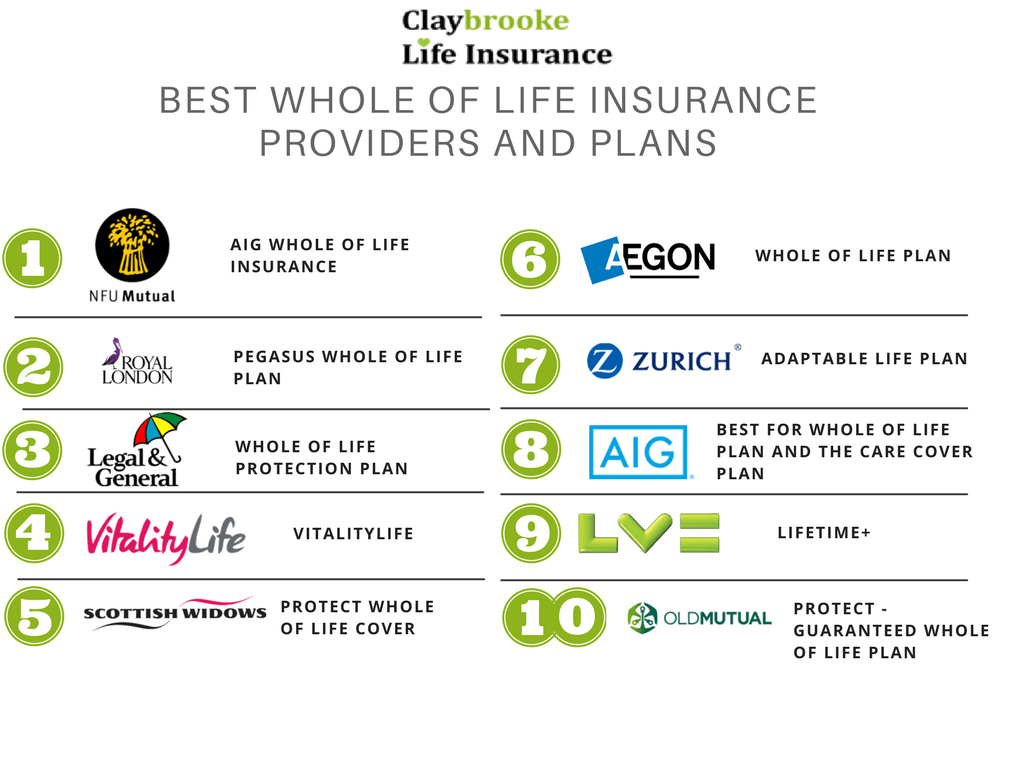

Best Whole Of Life Cover life insurance quotes

Whole of Life cover guarantees a cash lump sum pay-out to your loved ones, whenever you die.

There’s no expiration on this, like there is with term life insurance. Term life cover does not have a cash-in value, so if you live past the term of the policy, you get nothing back. That’s for financial protection only.

Whole-of-life cover is more appropriate for forward financial planning.

For example, arranging this level of cover, writing it into Trust, thereby ensuring it’s paid out tax-free, helps to avoid the most hated tax in Britain—the Inheritance Tax, aka the Death Tax, which is currently around 40% of an entire estate.

Getting financial advice from an independent financial advisor is advised to ensure your Trust is set up efficiently.

Best Means Based on What’s Covered for a Baseline Price…

Insurance quotes for life cover take into account personal circumstances, which can affect premiums.

The majority of plans and providers in the charts above provide comprehensive levels of cover, not just the basics. However, factors will influence the price at which the plans are offered.

Some of the things that add weight to the premiums include:

- What age are you at the time of application

- What your financial circumstances are like

- Current and past medical problems

- If you work in a medium to high-risk profession, e.g. scaffolding

Bottom line is this: No fixed rate applies to every application. All applicants are assessed as individuals.

Even for joint policies, the two applicants are assessed individually and offered plans tailored to their individual needs.

That’s why when you check comparison sites for quotes, they state a ‘from’ rate and never an actual price.

The charts above can be used as a quick reference to give you a shortlist of life insurance providers who can offer some of the best levels of cover at affordable prices. Many plans can be tailored to suit your individual needs.

For yourself to research policies, plans, and prices, quotes from ten of the best above will get you some good quotations.

An alternative is to let us do even more heavy lifting and compare over 300 of our partner providers to guarantee top-of-the-line plans and premiums within your budget.

Understanding Life Insurance Costs from the Best Life Insurance UK

Joint Life Insurance Policy VS Single New Life Insurance Policy

When you buy life insurance, you buy peace of mind for you and your family. Life insurance is for your family’s financial protection.

Term cover may only cover the cost of your mortgage, but the primary reason to have it in place is to protect your family from losing their home, should a wage-earner not be around to bring in a salary to pay the mortgage.

Term cover can depreciate in line with the remaining balance on the mortgage. That’s the most affordable type of life insurance.

Note that the payments don’t drop each year—just the payout—but that’s reflected over the term of the policy, which brings the premiums down.

The whole of Life cover is for leaving aside a fixed sum upon your death. The amount to be paid to your family is agreed at the outset, and the premiums will be payable for the rest of your life until the policy is paid out to your family.

Whole of Life cover is best for ensuring there is a fixed amount of money being left to your family.

Over 50s life insurance is the same as a guaranteed life cover plan. They’re tailored to those over the age of 50 who are likely to have health problems.

Often, for general term life insurance, there are numerous medical questions in the application.

Any previous diagnosis of a health concern will often increase the price you’re quoted. Don’t be tempted to lie, as that invalidates the policy, resulting in no payment being made when it’s required.

For those who are left feeling uninsurable because of past and present medical problems, over 50s guaranteed life cover may be suitable.

However, we would advise you to use a specialist broker to compare the whole of the market, which includes policies that aren’t advertised on mainstream websites or available on the high street.

Specialist brokers work directly with underwriters and can help you obtain life insurance for many circumstances.

You’ll have seen the over-50s plans advertised on the TV with the likes of Michael Parkinson emphasising the “no medical” aspect, the simplicity, and it costs as little as £4 a month, etc. Simplicity is the only selling feature these plans have.

The premiums are higher and the payouts lower in most cases, but there will be something left over, which is always better than nothing.

If you can obtain term cover or whole of life cover, those are better terms and prices.

The guaranteed element of over 50s coverage tends to decrease the value of the money the policies offer.

What Happens After You Buy Life Insurance?

When you purchase a life insurance policy, you enter into a legal contract between you, ‘the insured’, and, ‘the insurance company’, the firm you took the policy out with.

As it is a contract, there are terms attached to the policy. Most providers will issue the terms in advance before you agree to take the policy.

After accepting the offer, you’ll generally find a 30-day grace period for you to change your mind without paying any premiums should you choose to cancel.

When the official documents arrive, check the terms of any life insurance policy. Scrutinise them to ensure you know what’s covered and what’s not.

Understanding the terms of life insurance policies is critical to ensure you have the right level and type of cover.

Advice will help, and with us, we offer it free as a standard to ensure our customers get the best price for a life insurance policy that covers their every need.

There’s no point taking out an over 50s life plan because you’re 52 years old if you’re in good health.

You’d get a better deal on term life insurance, and for the premiums you’d pay for the guaranteed element of an over 50s plan, it may even be possible to put a whole of life insurance policy in place for much the same price or less.

More if you want to increase your insured sum, such as a £150,000 fixed pay-out.

You’ll want to ensure you have the correct number of years for a mortgage protection policy. If you have 10 years remaining on your mortgage, it should be a ten-year term policy linked to your mortgage and depreciating each year in line with the value of your outstanding balance.

It could cost more to take out a five-year term policy to be renewed five years later for another fixed term, as you could have developed ill health, which will increase the premiums.

Another thing worth considering on mortgage protection policies is critical illness cover or income protection. Often, ill health leads to financial difficulty, not the death of someone in the family.

How Much Cover is Enough Cover?

This depends on your financial commitments and what you want to ensure is paid, so your family won’t be in financial turmoil.

For homeowners, the bare minimum would be a mortgage protection policy (Term Life Insurance) for the outstanding balance on your mortgage.

For families, though, that won’t be enough coverage. Some advice goes along the lines of the most straightforward formula to work out how much cover you need is to multiply your household income by ten, and that’s the amount of life insurance cover you need.

It’s not.

Consider a newborn in a single-parent family. What’s the total cost? Research tells us that the total cost of a lone-parent raising a child from birth to 18 years of age is £187,120.

That’s just over £10,000 per year. So, for a family of four – two parents and two kids, one aged 10, the other 12, requiring an average £10,000 per year up until their 18th birthday, you’d be £80,000 + £60,000, totalling £140,000. Then, add the mortgage to that if that’s applicable.

Add on whatever you estimate funeral expenses to be. A traditional burial is estimated to be £4,257, and a cremation £3,311.

Then there’s the issue of outstanding debt—how much is owed? And covering for the loss of your or your partner’s income.

It’s easy to see that the figures soon add up, so your figure will likely be lower than you need. For example, if your ideal figure is £300,000, the premiums may be too high to afford comfortably.

Therefore, you’d need to prioritise what would need to be covered by your life insurance policy.

You could eliminate outstanding debt to bring your costs down, provided you had a plan to pay down outstanding balances.

There’s nothing to stop you having more than one policy, therefore, a term insurance policy could be the budget option to ensure the mortgage is taken care of and a separate term policy to cover the cost of raising children.

For grandparents, the costs are often much different. Sometimes, it’s an over-50s guaranteed plan to ensure the end-of-life costs are met, and other times, it’s financial planning for grandkids, ensuring that each is left with perhaps a little something to put towards owning their own home.

Or, they may have both: an over-50s plan to cover burial costs and another insurance policy to leave cash behind to their family.

How much is life insurance roughly going to cost?

It’s impossible to price exactly because there are so many variables because of the individual nature of application assessments. However, instead of just stating the same as almost everywhere else, it depends, which is useless…

Here’s a ballpark figure…

Data obtained from a survey in 2024 estimated the average term life policy for a 38-year-old male in good health to be £10.31 per month on a 25-year term policy for a sum insured of £100,000. If that person was a smoker, the premium would almost double to £20.14 per month.

In Conclusion:

You need to know a few things to get the best out of our top insurance providers and plans.

- The type of cover that would be most suited to your personal circumstances

- The amount of cover you would need your plan to cover

- Any special circumstances that could affect your policy such as existing illnesses, working in a risky occupation, a family history of certain medical conditions, your lifestyle etc.

The providers and plans on our charts have exceptional policies and rank highly for customer experiences.

However, they are all terrible at explaining the terms of the policies. Transparency is an industry-wide problem for the insurance sector, and that’s where we step in.

Our comparison, quotation and advisory service is free to consumers. We have partnerships with all the major insurance firms and a range of niche insurance providers catering to high-risk policies.

Get in contact today for straightforward advice, without any obligation.

Does Claybrooke Life Cover offer all UK life insurance companies?

Yes, Claybrooke Life Cover does life insurance at £26.77 per month for £265000 of cover.

Does Claybrooke Life Cover do the best term life insurance?

Yes, Claybrooke Term Life Cover life cover is £31 per month for £278000 of cover.

Does Claybrooke Life Cover offer Life insurance over 50?

Yes, Claybrooke Life Cover Life insurance over 50 is £10.14 per month for £280000 of cover.

Does Claybrooke Life Cover offer Income protection insurance?

Yes, Claybrooke Life Cover Income protection insurance is £10.69 per month.

Does Claybrooke Life Cover do mortgage life insurance?

Yes, Claybrooke Life Cover mortgage life insurance is £6.74 per month for £226000 of cover.

What are the current Claybrooke Life Cover rates for critical illness cover?

Claybrooke Life Cover interest rates for critical illness cover is £7.58 per month for £285000 of cover.

Do Claybrooke Life Cover have excellent reviews for life insurance?

Yes, Claybrooke Life Cover reviews are superb for life insurance. Plus we offer the opportunity to add critical illness cover.

Does the Claybrooke Life Cover life insurance calculator show the monthly costs?

Yes, the Claybrooke Life Cover life insurance calculator shows excellent monthly direct debit payments.

Does a Claybrooke Life Cover life insurance advisor charge a hefty fee?

No, Claybrooke Life Cover life insurance advisors are free. The life insurance company, will have the same life insurance cost regardless of the introducer.

Does Claybrooke Life Cover offer whole of life insurance?

Yes, Claybrooke Life Cover Whole Life Insurance is £9.49 per month for £229000 of cover.

Does Claybrooke Life Cover offer Joint life insurance or just a standard life insurance policy?

Yes, Claybrooke Life Cover Joint life insurance is £36.23 per month for £279000 of cover.

Does Claybrooke Life Cover offer Terminal illness cover?

Yes, Claybrooke Life Cover Terminal illness cover is £30.08 per month for £295000 of cover.

Does Claybrooke Life Cover offer Term life insurance?

Yes, Claybrooke Life Cover Term life insurance is £8.97 per month for £245000 of cover. We can offer the best life insurance quotes with fixed monthly premiums.

Does Claybrooke Life Cover offer Decreasing term life insurance from a well-established life insurance provider?

Yes, Claybrooke Life Cover does decreasing term life insurance at £10.2 per month for £289,000 of cover.

Does Claybrooke offer do Increasing term life insurance?

Yes, Claybrooke Life Cover does increasing term life insurance at £9.15 per month for a tax free lump sum £256000 of cover. Typical life insurance claims are paid within 30 days.

Does Claybrooke Life Cover do Level term life insurance?

Yes, Claybrooke Life Cover does level term life insurance at £10.7 per month for £218000 of cover.

Does Claybrooke Life Cover do Family income benefit life insurance?

Yes, Claybrooke Life Cover does family income benefit life insurance at £9.65 per month for £200000 of cover.

Can Claybrooke help me work out how much life insurance I need so the life insurance payout offers sufficient family financial protection?

Yes, Claybrooke can provide accidental death benefit insurance, lump sum payout cover, and decreasing term cover, so the level of protection is appropriate.

Can I save money if I get a decreasing term policy?

Yes, if you have a repayment mortgage, a decreasing term insurance policy could save you money and make life insurance payouts fit your mortgage. However, the monthly payments must be affordable.