The most popular question from policy seekers is, “How much should I expect to pay for £100,000 of life insurance?”

The answer is not as straightforward as we might think, since all insurance companies offer different policies with varying options at different prices.

A rough rule of thumb for a £100,000 Life Insurance Policy is around £10 per month. That’s the average monthly cost for a single life insurance policy.

Before buying life insurance for £ 100,000, it is wise to consider several factors and ensure that you are choosing the right policy and the right amount of coverage for you and your family.

Do You Require £100K Of Life Insurance Cover? Get A Quick Quote Today

A Review of Life Insurance For Comprehensive Family Financial Protection

Before getting too deep into the different life insurance options and quotes, it is important to review what life insurance is.

Life insurance is an agreement between a policyholder and an insurance company.

As part of this agreement, the policyholder pays monthly premiums to the insurance company in exchange for payment to their beneficiaries when the policyholder passes away.

This payment is used for final expenses, outstanding debt, and the cost of living for surviving family members.

£100,000 Life Insurance In Summary

| Question | Summary |

|---|---|

| Example monthly cost? | From £3.53/month for a 20‑year, non‑smoking applicant via L & G through Claybrooke |

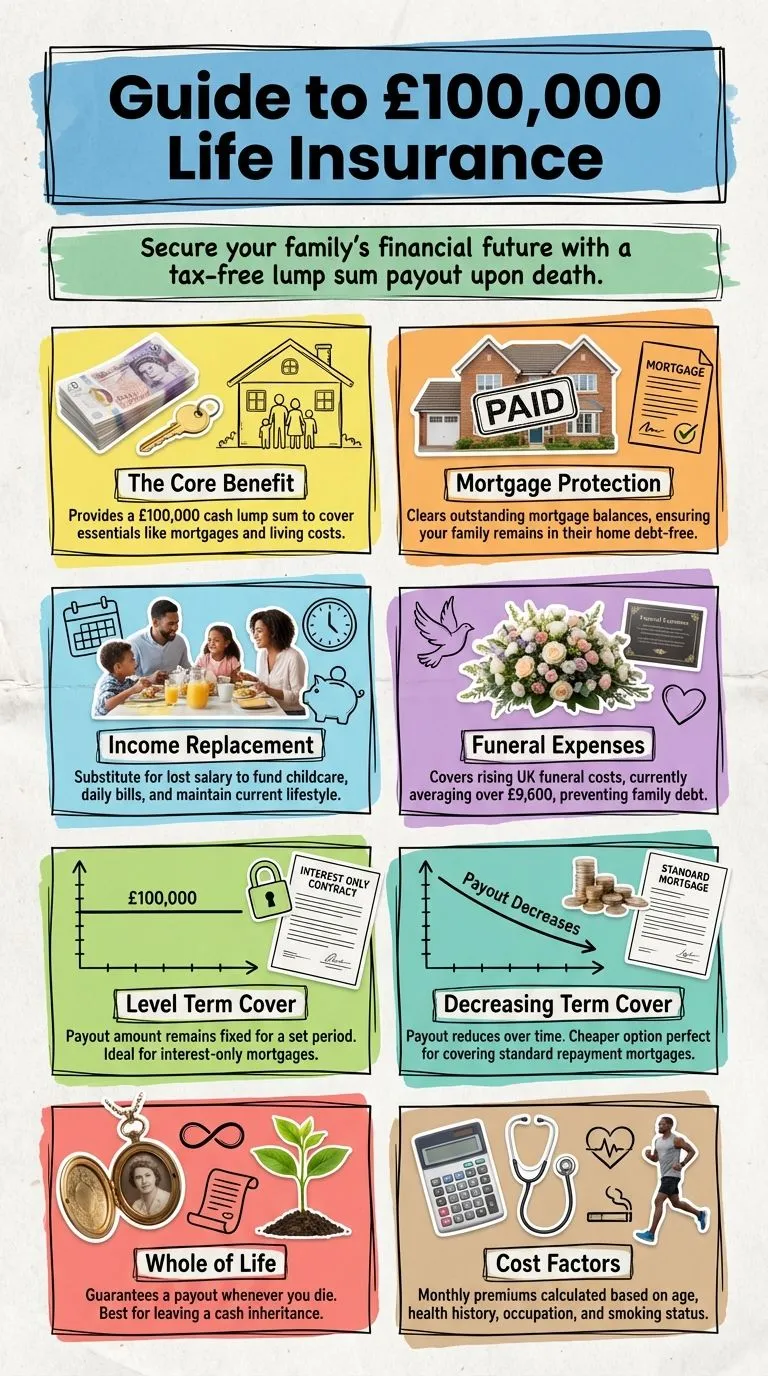

| Coverage amount? | Payable lump sum of £100,000 or over to help with mortgage, living costs, debts, childcare, funeral, inheritance |

| Factors affecting price? | Age, health, lifestyle (smoking, hobbies), occupation, policy type, length of term |

| Is £100,000 enough? | Depends on mortgage, debts, living costs, funeral & childcare needed—use a calculator to assess |

| Purchase options? | Via online quoting or speaking directly with Claybrooke’s advisers |

| Policy Type | Key Features |

|---|---|

| Level Term Life | Level term cover provides a fixed lump sum payout if you die during the policy term, making it ideal for protecting a mortgage or supporting your family financially. |

| Decreasing Term Life | – Cover reduces over time, matching a repayment mortgage. Lower cost than level term. Covers decreasing debt. Sum assured up to £1,000,000. |

| Whole of Life | – Lifelong cover (guaranteed payout). The payout stays level until death. Suited for funeral costs or inheritance planning. Up to £1,000,000 cover. Premiums are significantly higher than term. |

Types of £100 000 Life Insurance Policies

There is not one single kind of life insurance. Every insurance company offers several different types of policies that work in many different ways.

All of these policies have different requirements and carry different monthly premium payments.

Before deciding whether you want or need £100,000 of life insurance, consider these policy options.

Level Term

Level Term Assurance requires the policyholder to pay a set premium for a set number of years.

Should the policyholder pass away within the set number of years, commonly referred to as the term, the insurance company must pay a lump-sum cash benefit to the policy’s listed beneficiaries.

The lump-sum payment received from a Level Term Assurance policy is often used to pay off mortgage debts, credit cards, personal debts, and final expenses and cover the family’s cost of living.

Mortgage Life Insurance

Mortgage Life Insurance works the same way as Level Term Assurance.

Instead of having set, steady premium payments and a set amount of coverage, the premiums and coverage decrease throughout the policy’s life.

This means that, over time, the policy becomes less expensive to maintain but also offers a smaller lump sum payout.

Individuals concerned about ensuring their mortgage balance is covered when they pass away often use this.

Whole Of Life Cover

Whole of Life Insurance has set premium payments and a set lump sum pay-out but the policy covers the holder for their entire life instead of just for a set amount of time.

Since the coverage for this type of policy is extended, the premiums for Whole of Life Insurance are often more expensive than Level Term or Mortgage Life Insurance.

This type of policy is often chosen by people who constantly need their lump sum payment to be given to beneficiaries for various expenses.

Family Income Benefit

Family Income Benefit works in the same way as Level Term Assurance.

Instead of beneficiaries receiving a lump-sum payout upon the holder’s death, they begin receiving regular payments to supplement the policyholder’s income.

This type of policy is most often chosen by a holder who does not wish for their beneficiaries to receive a lump sum, but instead have a continuous income stream.

This is often the case when beneficiaries are young children or young adults, to help with cash management.

Click To Compare QuotesHow Much Life Insurance Do I Need?

For the main breadwinner in the home, you need life insurance cover that is roughly 10 years of your pre-tax wages. It is very rare for £100000 life insurance to be appropriate.

Cost of A New Life Insurance Policy Explained

The insurance company determines the premium payments, or the “cost of life insurance per month,” based on several factors.

Some of the most common areas that life insurance companies look at are:

- The type of insurance you are looking for

- How much are you seeking in a cash lump sum payment

- The term or length of the policy

- How old and how healthy the policyholder is

- What lifestyle choices does the policyholder make

- Smoker or non-smoker

While these are the most common factors, it is important to note that all insurance companies are different and weigh factors differently.

Amount of Life Insurance Needed, and What Are The Life Insurance Premiums?

The level of life insurance coverage the policyholder chooses is determined by what they want and what they need in a life insurance policy.

While this choice will be unique to each individual, there are some questions you can ask yourself to help determine how much coverage you may need.

Consider how your final expenses will be paid, how outstanding mortgages and personal debts will be handled, and how your family will afford to live after your income is no longer available.

Additional Life Insurance Considerations For Appropriate Family Financial Protection And Funeral Costs

While we hit many of the most critical factors that play into your choice of life insurance policies, there are some additional considerations you may want to make when making a final decision.

For those policy seekers with a spouse, you may consider a joint life insurance policy.

Click To Compare QuotesWhile having a joint policy is great from a budgeting standpoint, since there is only one premium payment, it is important to note that this type of policy will pay out only once, when the first policyholder passes away.

Having two policies is twice as expensive, but it also means there is double protection for the family.

The policyholder’s health should also be an important consideration when choosing a life insurance policy.

If you have a chronic condition or multiple health problems, it may be beneficial to speak with a life insurance specialist.

Claybrooke’s insurance advisors can help match policy seekers with medical issues with insurance companies willing to work with them.

This can often help avoid unnecessarily high premium payments based on the holder’s overall health.

Your Questions Answered By The Claybrooke Team:

Does Claybrooke do Life Cover?

Yes, Claybrooke life cover is £21.37 per month for a £204,000 life insurance payout. This is an example of a recent policy for a UK customer.

Do we offer Life insurance over 50?

Yes, Claybrooke Life insurance over 50 is £29.12 per month for £287,000 of cover.

Is income protection insurance available?

Yes, Claybrooke Income protection insurance is £28.17 per month.

Does Claybrooke do mortgage life insurance?

Yes, Claybrooke mortgage life insurance is £27.65 per month for £221,000 of cover.

What are the current rates for critical illness cover?

Claybrooke’s rates for critical illness cover are £26.03 per month for £207,000 of cover.

Does Claybrooke have good reviews for life insurance?

Yes, Claybrooke reviews are commendable for life insurance.

Does a life insurance calculator show the monthly costs?

Yes, the Claybrooke life insurance calculator shows good monthly direct debit payments.

Do our life insurance advisors charge a substantial fee?

No, Claybrooke life insurance advisors are free.

Does Claybrooke do whole of life insurance?

Yes, Claybrooke Whole Life Insurance is £28.76 per month for £285,000 of cover.

Is joint life insurance available?

Yes, Claybrooke Joint life insurance is £27.77 per month for £258,000 of cover.

Does Claybrooke do Terminal illness cover?

Yes, Claybrooke Terminal illness cover is £27.54 per month for £245,000 of cover.

Does Claybrooke do Term life insurance?

Yes, Claybrooke Term life insurance is £26.60 per month for £238,000 of cover.

Does Claybrooke offer Decreasing term life insurance?

Yes, Claybrooke does decreasing term life insurance at £27.58 per month for £276,000 of cover.

Does Claybrooke offer Increasing term life insurance?

Yes, we can offer you increasing term life insurance at £28.32 per month for £260,000 of cover.

Does Claybrooke offer Level term life insurance?

Yes, we offer level term life insurance at £19.93 per month for £206,000 of cover.

Does Claybrooke offer Family income benefit life insurance?

Yes, we can provide family income benefit life insurance at £10.45 per month for £298,000 of cover.

Other things to consider when you are offered a life insurance cost estimate:

- Can you compare life insurance quotes without studying the terms?

- Does the life insurance quote suit your personal circumstances, and do you need to add critical illness cover?

- Have you considered additional childcare costs?

- If you have an interest-only mortgage, will cheap life insurance pay the principal?

- The mortgage life insurance policy could be cheaper if you have a repayment mortgage.

- Life insurance depends on your family’s likely living costs, so the tax-free lump sum must manage their financial commitments and your funeral expenses.

- If you are stretched financially, you may be better off getting critical illness insurance to provide financial protection, and cancel your current life insurance company.

- Two single life insurance policies can be more expensive than a joint term life insurance policy, but all rely on your family medical history.

- Your pre-existing medical conditions, smoking status, high-risk hobbies and any current serious medical conditions will need to feature in the life insurance calculator inputs.